Inflows into the DeFi sector witnessed an uptick as the wider crypto market recovered and investor sentiment improves.

Decentralized finance (DeFi) has had a rough go so far in 2022, and data from Messari shows the top ten-ranked DeFi assets currently down between 10% to 50% since the start of...

If you are one of the millions of Americans who live paycheck to paycheck, you may think about trying to improve your financial situation. It often feels impossible to change your financial situation enough for you to stop counting every penny you make, but the good news is that...

One of the most unexpected effects of the pandemic has been the incredible rise in property value. Since mid-2020, property prices throughout the US have climbed at record rates. This trend has surprised many economists, especially those who thought that job losses would lead to a lack of demand...

After over two years of health restrictions, social distancing measures, and extreme lockdowns as a result of the COVID-19 pandemic, the world is now finally recovering from this catastrophe, with people returning to work and businesses being able to thrive once again. As we near the end of the...

You may not have even noticed a change to your bank, and the shifts that they are taking. The money and time that they have spent to meet your demands has, more than likely, not given you any reason to even pause while completing your banking needs. You have...

Thanks to smartphones, we can manage virtually every aspect of our lives on the go. From healthcare to budgeting, financial apps are a valuable resource that every adult should download. You may be used to taking a backseat to money management, especially if you're financially secure. While someone with...

It’s no surprise that more and more individuals have started some online businesses in the last couple of years. The reason for that cannot get more superficial. Basically, everyone with a good internet connection can make money, and the earning opportunities are enormous. Of course, if you know what...

Banks and credit card companies will put interest on their loaning products to make money. That money offers cardholders a solid incentive to pay off their balance off by the end of the month.

However, the amount of interest you pay can change depending on the card you have, the...

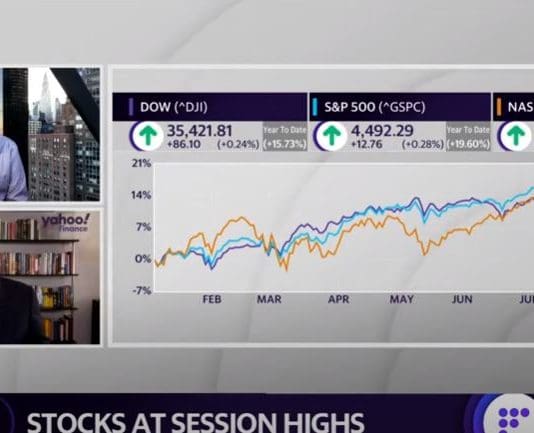

Jeffrey Gundlach, DoubleLine Capital Founder & CEO, joins Yahoo Finance's Julia LaRoche and Brian Sozzi to discuss the Federal Reserve, stimulus, and the economy.

Sam Stovall, CFRA Chief Investment Strategist, talks about investor concerns and a "taper tantrum" emerging in 2021.

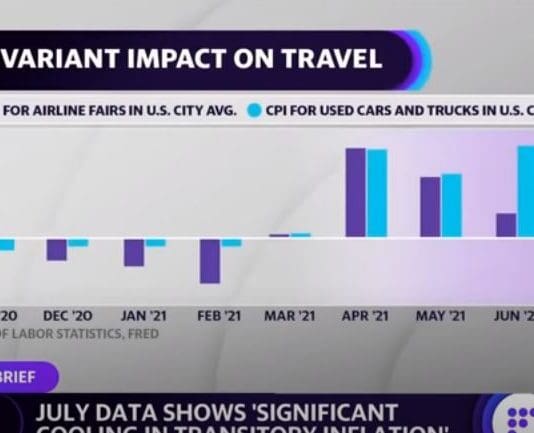

Oppenheimer Managing Director and Chief Market Strategist John Stoltzfus joins Yahoo Finance's Adam Shapiro and Seana Smith to discuss mergers and acquisitions, sectors to watch, the delta variant, and the outlook for stocks.

Yahoo Finance's Adam Shapiro reports on the House approving the $3.6 trillion budget blueprint advancing the process of the reconciliation of the budget and it also advances the $1 trillion infrastructure bill with a House vote on September 27th.

David Zervos, Jefferies Chief Market Strategist, joins Yahoo Finance's Julia LaRoche to discuss the outlook on the economy, consumer sentiment, the labor market, and Fed expectations.

Keith Fitz-Gerald, Fitz-Gerald Group Chief Investment Officer, joins Yahoo Finance's Brian Cheung to discuss the market impact from the latest retail sales data, investing in the infrastructure space, outlook on Fed tapering, and earnings season.

Yahoo Finance’s Jessica Smith spoke to Yahoo Finance's Jessica Smith to discuss the Exclusive Op-Ed from Treasury Sec. Janet Yellen.

Capital Wealth Planning Founder & Chief Investment Officer Kevin Simpson joins Yahoo Finance's Adam Shapiro and Seana Smith to discuss new PPI data, inflation and the Fed.

Yahoo Finance's Myles Udland discusses inflation with Julie Hyman.

Yahoo Finance's Brian Cheung breaks down what to expect from the Fed near the end of 2021.

Yahoo Finance's Stephanie Asymkos breaks down investment mistakes to avoid including overconfidence, selective memory, self limitation, loss aversion, and sunk costs.

Households boost borrowing amid COVID-19 recovery with largest increases in debt balances since 2007

Yahoo Finance’s Brian Cheung joins the Yahoo Finance Live panel to discuss the latest as Americans are starting to take loans out again: NY Fed.