It was a disaster waiting to happen. High-flying Archegos Capital’s fortune came crashing down in a growing sign of the investor’s insatiable hunger normally getting the better of sane judgment despite a bull run that has so far pushed up the S&P 500 Index by close to 80%.

Global banks are expected to lose over $6 billion as Archegos Capital’s downfall is expected to badly hit those with exposure to the American Investment firm. This crash could have a cascading effect and negatively affect the fortunes of other stocks.

The major trouble at 888 7th Avenue headquartered hedge fund is as yet limited to a few stocks. But they are significant, with major names like Discovery and ViacomCBS involved. Shares of major investment banks, such as Credit Suisse, that had dealings with Archegos were also impacted.

Nomura of Japan has also warned of heavy losses. This has led to a global sell-off of stocks in banks. But there are still no indications of any ripple effect enveloping the larger market as yet.

Archegos Capital’s Crash Badly, Affects Majors Players

Goldman Sachs Group was down 1.7% and Morgan Stanley slid 2.6%, while Nomura was badly hit and went down 16.3%. It was a record slide for the Japanese Major. It was equally bad for Credit Suisse as it had its greatest loss in a year and went down 14%. UBS was down 3.8%, while Deutsche Bank slid by 5%.

ViacomCBS, the media giant was badly hit as a below-par stock sale triggered distressing margin calls. Its shares fell 23%, compounded by calls by analysts that the stock was overvalued.

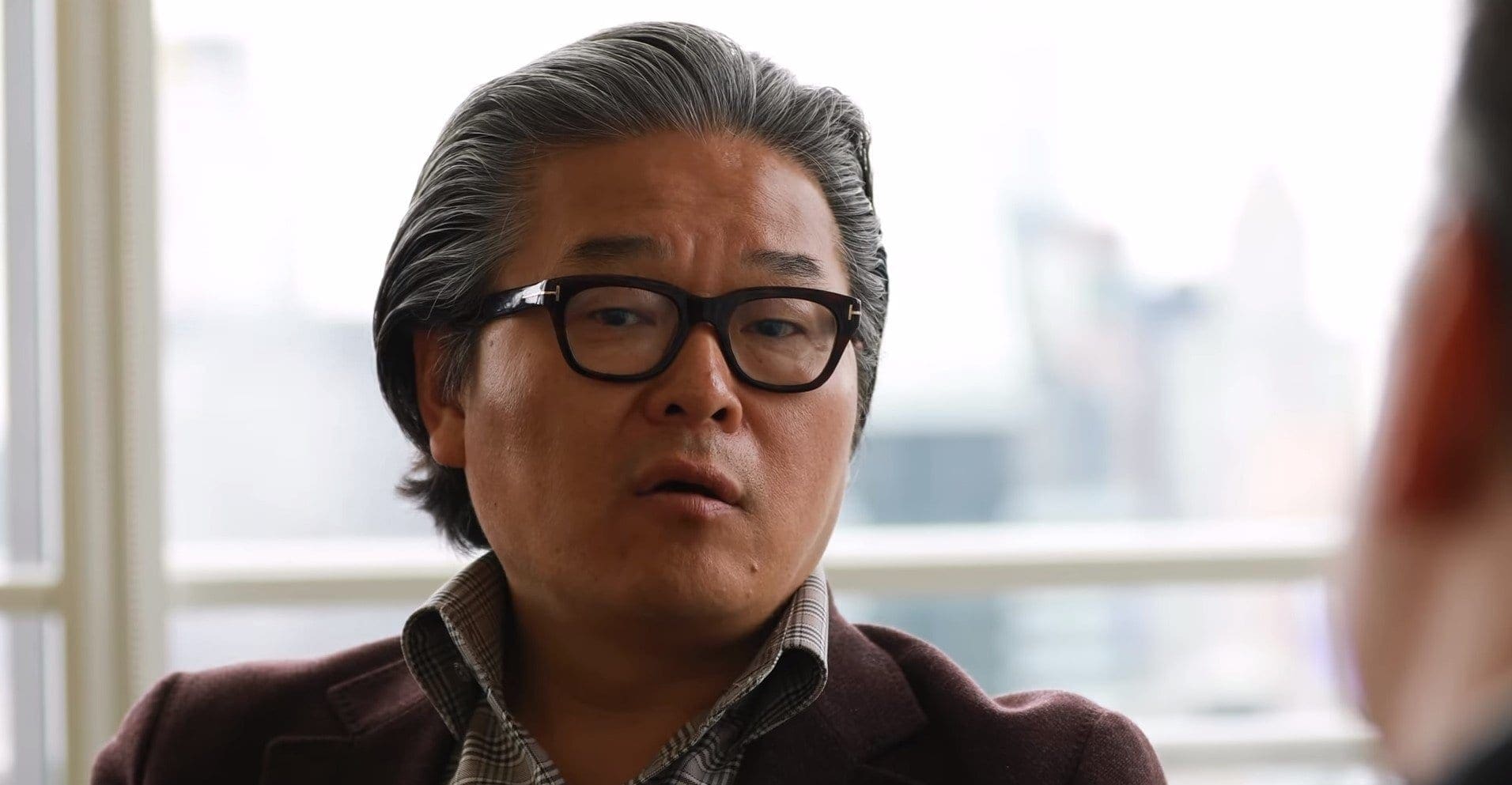

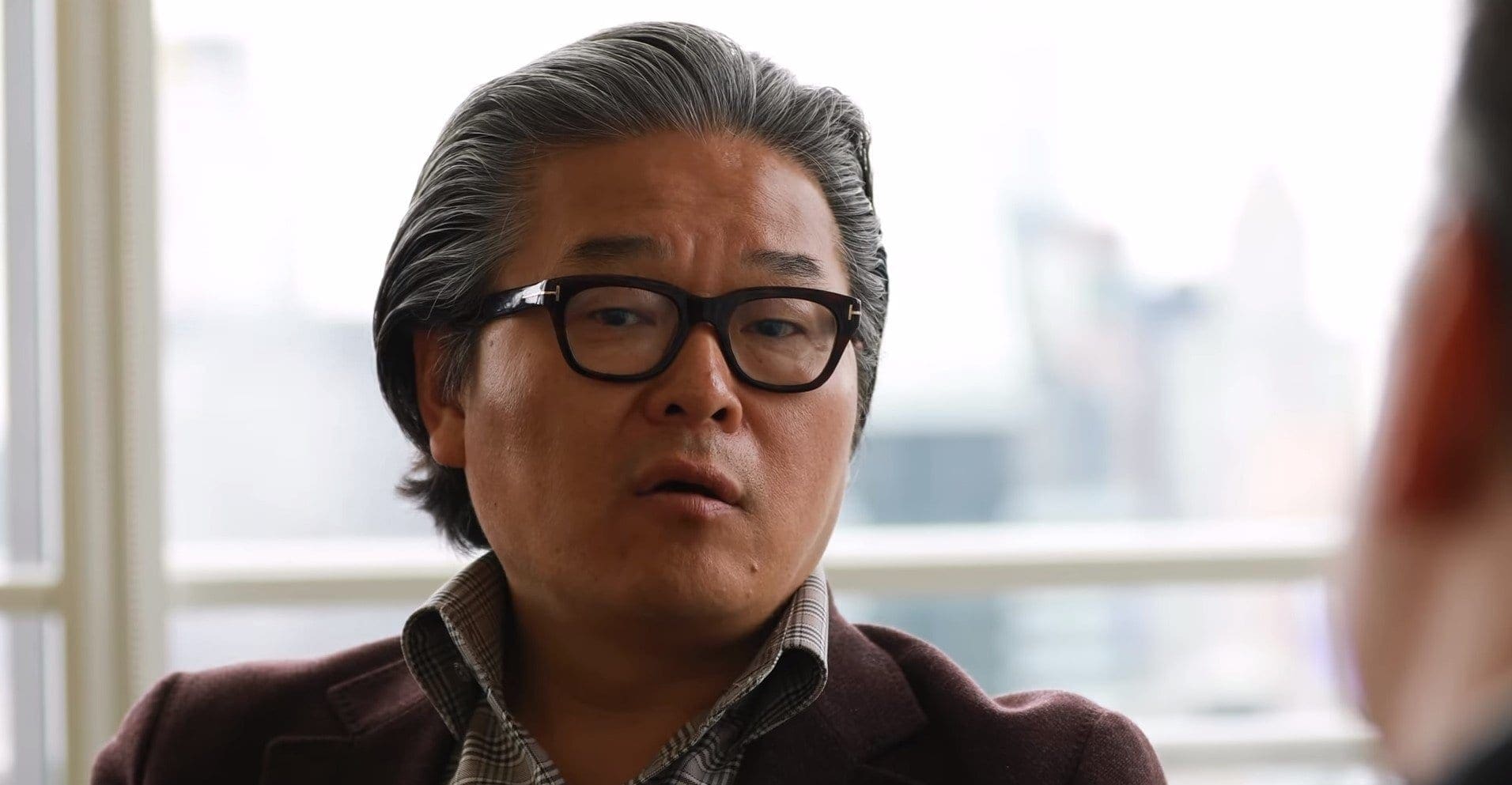

The losses at the family office of Archegos Capital Management, helmed by Bill Hwang, former manager of Tiger Asia sparked a sale in major stocks such as Discovery.

The top management of the distressed firm was in a fire-fighting mode and revealed that the team was determined to take the best course forward, as revealed by Karen Kessler, the company spokesperson.

The Danger Signs At Archegos Had Been Too Frequent

But Archegos was not able to meet the call for extra collateral to anchor trades in equity swap which the firm had financed partially. As those positions crashed in value, investors dumped large blocks of those securities in a desperate attempt to recover their losses.

The firm had made bets on stocks that had over-performed before. But a change in fortunes caused a rippling effect on their performance.

There are further indications that the market sentiment had recently been too exuberant than warranted. This had led to a tendency to take undue risks over asset classes.

This blind run was visible in the voracious enthusiasm for SPACs (Special Purpose Acquisition Companies), a high-risk category as such companies are born with the sole purpose of raising capital through an IPO to solely fund the acquisition of an existing company. They have no other commercial operations as such. They have been disparagingly called ‘blank check companies.’

Other worrying signs have been the popularity of Bitcoin and other cryptocurrencies, and the 850% rise in shares of American Video game retailing major, GameStop that was prodded by retail backers aided by a preference for sites with aggressive trading strategies such as WallStreetBets, a subReddit famous for its colorful jargons.

These are the companies that will be picked out for having fuelled the rampant risk taken by the market, that saw low standards of analysis and runs fuelled by greed and a mob-sentiment.

A Rogue Run Riding On Favorable Sentiments

Equities account for half of all the assets with pension funds, mutual funds, foreign investors, and individual investors. It is the highest post the tech runs a couple of decades back. Many investors have gone in towards backing on the stock exposure. Trading in equity options was up 85% in 2020 compared to 2017, as revealed by Trade Alert.

A brief lull caused by the outbreak of the COVID-19 pandemic last year has been followed by strong positive sentiments from both individual and institutional investors alike as they expect better times to come.

Bank of America’s Global Research analysis has strongly pushed up its exposure to commodities. They have pinned strongly on an expected global market recovery, though cash levels are at an all-time low over 8 years.

Positive sentiment among individual investors is balanced with 51% expecting a rise in the short term, though this is way above the historical average figures of 38%. This was revealed by new research figures from the American Association of Individual Investors Sentiment Survey.

Riding On The Stimulus Wave

Individual investors have largely relied on the unbelievable volume of stimulus payments given out by U.S. Lawmakers plus the Federal Reserve. And this positive sentiment has been buoyed by the rollout of the COVID-19 vaccines across the country.

Federal Reserve representatives had given out earlier that the expected growth was 6.5% for 2021. This would indicate the greatest expansion post the 80s. 2020 saw a 3.5% reduction, the worst downturn in seven decades.

Market analysts are generally of the opinion that American stocks will generally end this year a lot higher, though the road will see rough times ahead.

But such confidence which is not founded on strong results could lead investors to go for risks like over utilizing leverage. This will help in blowing up gains but also lead to rapidly spreading losses if any particular trade goes sour.

The example of Archegos Capital can be cited as to how leverage can bring disaster without warning. The firm invested in derivatives called total return swaps that let investors wage on the movement of stock prices without even owning the original securities.

Despite owning assets less than $10 billion, Archegos controlled positions worth over $50 billion said an anonymous source.

Market sentiments have been unduly bullish this year, and this makes investors take unwarranted risks, said a senior strategist with WallachBeth Capital, Ilya Feygin.

Regulators Turn Their Lenses Towards Archegos

Markets are still worried that the full impact of Archegos Capital’s woes is yet to be felt. The trouble was compounded by the complex nature of the firm’s derivative trade and the lack of transparency. Hwang had been at the helm of Tiger Asia between 2001 and 2012, renamed it Archegos Capital, and converted it to a family office according to the firm’s website.

Other managers of hedge funds have pondered over Hwang’s decision to bet on Discovery and Viacom CBS, given their mediocre standing in the market.

Such firms operate as personal wealth managers and so have much lower disclosure norms than regular investment companies. Hwang’s firm had paid off $44 million in 2012 to settle insider trading charges leveled by the Securities and Exchange Commission.

There has been a lack of regulatory monitoring and this has raised concerns about inherent and systemic rot. Regulators across the globe were closely watching developments.