Gross domestic product, or GDP as it is more commonly known, is one of the most important concepts in the field of economics.

As a concept, it is used by politicians and economic analysts alike to get a sense of how well or how poorly an economy is performing. It can help businesses judge when they need to expand their operations and to hire new staff, while also helping policy makers know when it is time to tighten a country’s fiscal spending.

Despite the importance of GDP and the frequent references to it in the news, however, many of us lack a basic understanding of what GDP actually is, how it is calculated and why it matters!

If you are one of these people and have found yourself scratching your head whenever it gets mentioned in the press, keep reading this article for a basic overview of GDP.

What is GDP?

Taken at its most basic, GDP is an attempt to measure all the economic activity in a country. This includes the economic activities of companies, governments and even individuals.

It is the total monetary — or economic — value of all the finished goods and services produced within a particular region, although most often a country, within a specified time period. When it is taken as a wider measure of the total domestic production, it tends to be used as an indication of the overall economic health of a country.

GDP is most often calculated on an annual basis, although government and economic analysts will frequently refer to GDP figures calculated on a quarterly basis. This is true of the US Government, who release annualized GDP estimates for both individual fiscal quarters and the entire year.

Professionals in the finance world and other corporate actors tend to pay close attention to the quarterly figures calculated every three months, as these provide an ongoing scorecard and rough assessment of how the economy is performing.

With this basic understanding of what is GDP in mind, however, let’s move on to better understanding how it is calculated.

How is GDP calculated?

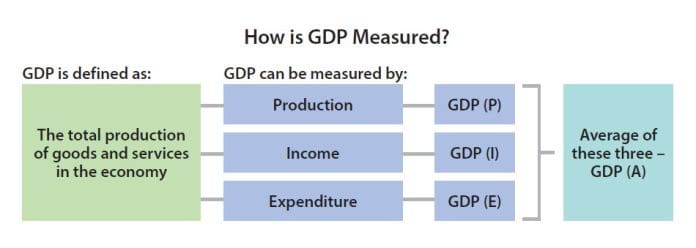

Despite the definitions of GDP all being fairly similar, there are various ways of calculating GDP. There are three main ways that GDP tends to be calculated:

- Output: The output measurement looks at the total value of the goods and services produced by all sectors of the economy. This includes everything from manufacturing to agriculture, construction and the services sector.

- Expenditure: The expenditure measurement looks at the value of goods and services bought by households and by government, as well as capital investment and construction. It also incorporates the value of exports from the country, minus the imports into it.

- Income: This measurement looks at the total value of the income generated within a country, primarily with reference to corporate profits and individual wages.

Another factor in how GDP is calculated is the type of GDP you are looking to measure. Broadly speaking, there are five different measures:

- Nominal GDP: This is the assessment of economic production that doesn’t account for inflation.

- Real GDP: This is an inflation-adjusted measure of GDP.

- GDP per capita: The measurement of GDP per person in a country. This calculates the amount of economic output per person.

- GDP growth rate: This compares year-on-year GDP growth.

- GDP purchasing power parity: Similar to GDP, economists will use purchasing power parity to compare GDP between different countries, accounting for local and regional economic differences.

Why does understanding GDP matter?

GDP figures are closely watched by a wide variety of actors and professionals across various industries. This is in addition to government officials, who will often tailor their policies in response to GDP figures in combination with other available economic data.

Economies that are growing and exhibiting positive growth tend to show quarterly increases in GDP adjusted for inflation, which shows that more work is getting done and that people’s personal wealth is increasing. For governments in particular, GDP growth brings with it greater tax revenue, which helps to run the country and deliver on policy promises.

On the other hand, if GDP is falling on a quarterly basis, this is an indication that the economy is shrinking and becoming less productive. It also signals that a drop in tax revenue could be on the way. Most importantly, if GDP drops for at least two quarters in a row, this is often taken to mean that an economy has slipped into recession.

This will have an immediate impact on individuals in that economy, as it increases the risk of reduced availability of public services and job losses across all sectors of the economy. Governments tend to borrow in line with the size of the economy, so negative GDP rates can have an immediate impact in our daily lives.