FX Forwards 101: Why You Need To Hedge Against Foreign Exchange Downside

The problem associated with holding stocks, business interests, property, and generally any kind of asset in a foreign country is it comes with foreign exchange risk. One of the most common complaints from investors happens when their foreign holdings gain in value but the overall position loses money because of unfavorable currency fluctuations.

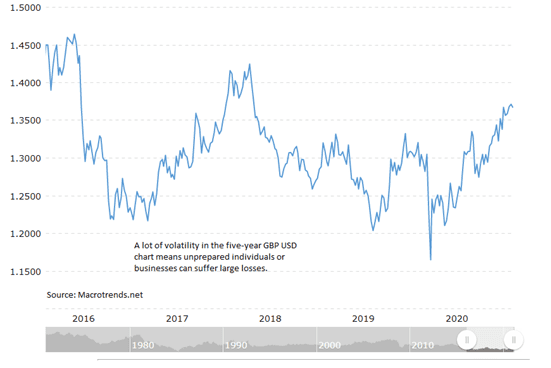

There is a simple way for individuals and businesses to hedge their global exposure through a forward contract. Forwards are a relatively new offering to the general public and has gained in popularity in recent years. The 2016 Brexit vote and COVID-19 pandemic made it clear that currencies can and will swing in unpredictable ways and leave unprepared individuals vulnerable to losses that could have been avoided.

What Is An FX Forward?

Forward contracts, also known as currency forward, FX forward, or simply as a forward, lets individuals or businesses buy or sell a currency pair at a fixed exchange rate on or before a predetermined date. A forward is a legal agreement that can’t be canceled and must be honored prior to the expiration date regardless of the current market price.

The closest comparison to a currency forward would be a stock option. In the equity universe, an option gives an investor the right to buy or sell a stock at a given price on or before a set date. The option is valid regardless of the current stock price.

Typically, 10% of the contract value is required upfront and the remaining 90% will be due when the currency forward contract reaches its maturation or expiration date.

Currency forwards is one of the main selling points of many online money transfer services. Some of the more popular money transfer services for FX forwards in 2021 include:

- Moneycorp.

- TorFX.

- Currencies Direct.

- World First Money.

- OFX Money.

Forward Contract Example: Buying Property

Suppose a wealthy businessman living in London wants to buy property in France. Living in the United Kingdom, the businessman earns pounds but the real estate seller in France lists their property listed in euros.

Buying property in France has become very complicated in the post Brexit reality. British citizens are now considered Third Country Nationals and face similar rules as non-EU citizens, like Australians or Canadians.

While not impossible or illegal to buy property in France, the process can become cumbersome and unnecessary long. As each day passes, the businessman risks paying more for the property if the pound loses value versus the euro.

Suppose the property is listed at 3 million euros, or 2.63 million pounds (1 euro = 0.88 pounds). Suppose that over the three months it takes for the real estate transaction to close, the pound loses 4% in value. This isn’t an unrealistic scenario as the pound has on several occasions lost more than 2% in a matter of days.

So, without taking proactive action via a currency forward, the businessman has no option but to pay an extra 4% or 100,000 pounds for the same property. Needless to say, more drastic shifts in the exchange rate could leave the businessman on the hook for a much higher buying price for the exact same property.

Instead of assuming foreign exchange risk, the businessman can buy a forward contract whereby he agrees to exchange in three months his 2.63 million pounds for 3 million euros. Most forwards have a duration of up to one year but it isn’t uncommon to purchase a long-duration forward of up to five years.

The businessman can sleep peacefully at night knowing that even the most extreme FX movements will have zero impact on the price required to purchase the property.

FX Confusion Bodes Well For Currency Futures Demand

Foreign exchange action in the first few weeks of 2021 was in some ways very confusing as currencies were showing irrational moves.

For example, the US dollar entered the new year with a lot of weakness, and the greenback was expected to continue shedding value. President Joe Biden’s plans to introduce a stimulus package potentially in the trillions of dollars was seen as a clear negative catalyst for the dollar by default of introducing new money into circulation.

Yet the dollar moved in the opposite direction after Biden detailed a $1.9 trillion stimulus plan in January. In fact, by early February, the U.S. dollar caught many investors off guard and sat at its highest point in more than two months.

Will the momentum continue throughout 2021 or will the greenback plummet as much as 20% — as predicted by major Wall Street firm Citi? Either way, an individual or business can hedge their US-dollar position through an FX contract instead of sitting back and hoping for the best as each day passes.

Across the Atlantic, the same confusion and irrational movement were seen in the pound. The currency entered the new year with little momentum as Brexit confusion and uncertainty dominated financial and news headlines. But much like the dollar, the pound gained momentum in the first few weeks of 2021.

As of early February, the pound was trading at a nearly eight-month high. What’s next for the currency? Experts are perhaps as mixed as ever. Fortunately, the direction of the pound isn’t much of a concern for holders of FX forward contracts.

As we can see, easy access to forward contracts through one of many online money transfer services will continue growing in popularity over time as few analysts expect volatility to ease in the currency markets.

Conclusion: Excellent Risk Mitigation Tool

The average person or business owner has little to zero experience in currency speculation so forward contracts allows the holder to better prepare for the future by guaranteeing a fixed exchange rate.

There is no reason for anyone to assume any risk in managing their international dealings. Fortunately, the advancement of technology in recent years makes it possible for anyone to gain access to a risk mitigation tool that was once reserved for global enterprises.

A forward FX contract is an excellent tool to mitigate risk although there are other tools available to hedge against uncertainty.