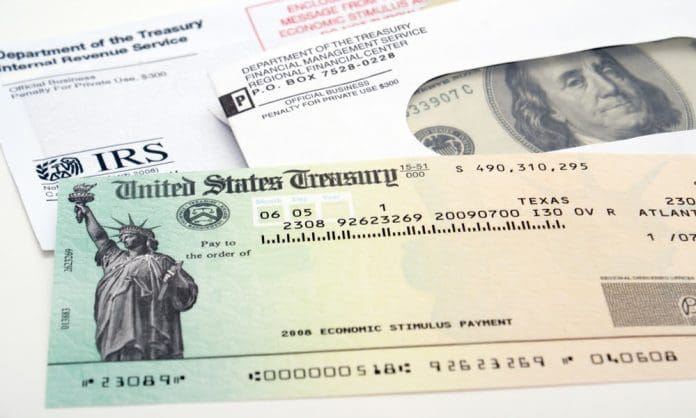

The IRS sent a press statement on January 23, 2023, marking the beginning of tax filing season. This tax filing period, which runs from January to April 2023, is for your 2022 tax returns. You’ll provide details about the money you made the previous year, and in certain situations, you’ll get a Stimulus Check (or in other cases, you may owe taxes).

The IRS issued a crucial caution on the effect of stimulus checks on the tax return you’ll submit this year in its press release. The IRS specifically said that because there were no government stimulus funds provided last year, you might not get the full amount of your tax return.

Stimulus Check For Certain Groups

Since many people depend on their tax refunds to aid in debt repayment, account growth, or the achievement of other significant financial objectives, it is crucial to read and comprehend this IRS caution so that you are not taken by surprise. The $1,400 check made possible by the American Rescue Plan Act was known as the Recovery Rebate Credit. The American Rescue Plan Act also increased the Child Tax Credit, giving parents $3,600 for kids under the age of six and $3,000 for kids between the ages of six and seventeen. These sums are applied to each child.

Millions of Americans received additional tax credits totaling thousands of dollars when they submitted their 2021 tax returns 2022 as a consequence of these two stimulus payments. However, as none of these stimulus check programs was extended in 2022, if you were accustomed to receiving that sizable refund due to the stimulus checks, you are likely to be quite disappointed this year when you receive considerably less money from the IRS.