The high inflation rate is here to stay and state governments are sending out stimulus checks to get money into the pockets of Americans. With federal stimulus support on hold, it is up to the states to fall back on their resources or turn to the American Rescue Plan Act funds to send out stimulus checks or tax rebates to their residents to cope with the record inflation.

The states moved in swiftly to help out residents primarily to cope with the high inflation that has for the first time in decades led to negative growth of income for millions of Americans. This is despite a rise in wages during the post-pandemic period.

The federal administration remains tied down by dep disagreements between the opposition and the Democrats in power. President Biden has even failed to convince a couple of his Senators to go ahead with more aid to Americans.

With the Senate split down the middle, this ensured that the ruling Democrats were always in a minority as a result of the 2 intractable Senators. To worsen matters, over 7 M people who have filed for their unemployment benefits since March are yet to be given their payments. The unemployment system in the state has been overwhelmed by the flood of applications as revealed by a study by the US Census Bureau.

The pandemic had a severe negative impact on the economy with the large-scale closure of businesses and other organizations. The unemployment figures as a consequence were unprecedented. The recession also ensured that a disproportionate number of Blacks, Latinos, low-wagers, women, and immigrants, while those who were caretakers in private facilities had no access to state or federal benefits.

Millions Continue To Be Deprived Of Both Unemployment Benefits And Stimulus Checks

Though more than a year has passed since the issue became prominent, the number of unemployed workers who have no access to unemployment benefits remains high and continues to mount. Though there has been a downward trend in the initial number of claims for jobless benefits, it remains around 800,000 weekly, way above the pre-pandemic record.

This has forced many of the unemployed to default on their utility bill and rent. The paltry amount that these unemployed earns generally goes towards the purchase of food and other emergency expenses and this has touched record levels.

Though several states such as California, ruled by the Democrats, have laws in place against utility shutoffs, the federal moratorium on eviction that was put in place during the pandemic draws to a close by the end of 2022. But these expenses are not a waiver and the affected will ultimately have to pay back such expenses. They have merely been deferred.

There is an overpowering helplessness and stress for tens of millions as they face a sustained period of unemployment or are paid at levels that are way below the pre-pandemic levels. This situation is worsened by the rise in prices that has even negated the rise in wages in several sectors.

With record inflation figures, the all-around price rise that covers everything from groceries to gasoline, and also the service sector, has led to negative wage growth despite a rise in post-pandemic wages.

This feeling of helplessness is compounded as all forms of federal stimulus checks have come to a halt and this has further taken a toll on the mental and emotional health of citizens.

And there is the fact that most of the benefits that they will ultimately receive will not help cover past dues and other pending bills. But the employment development section of multiple states continues to renege on their payments.

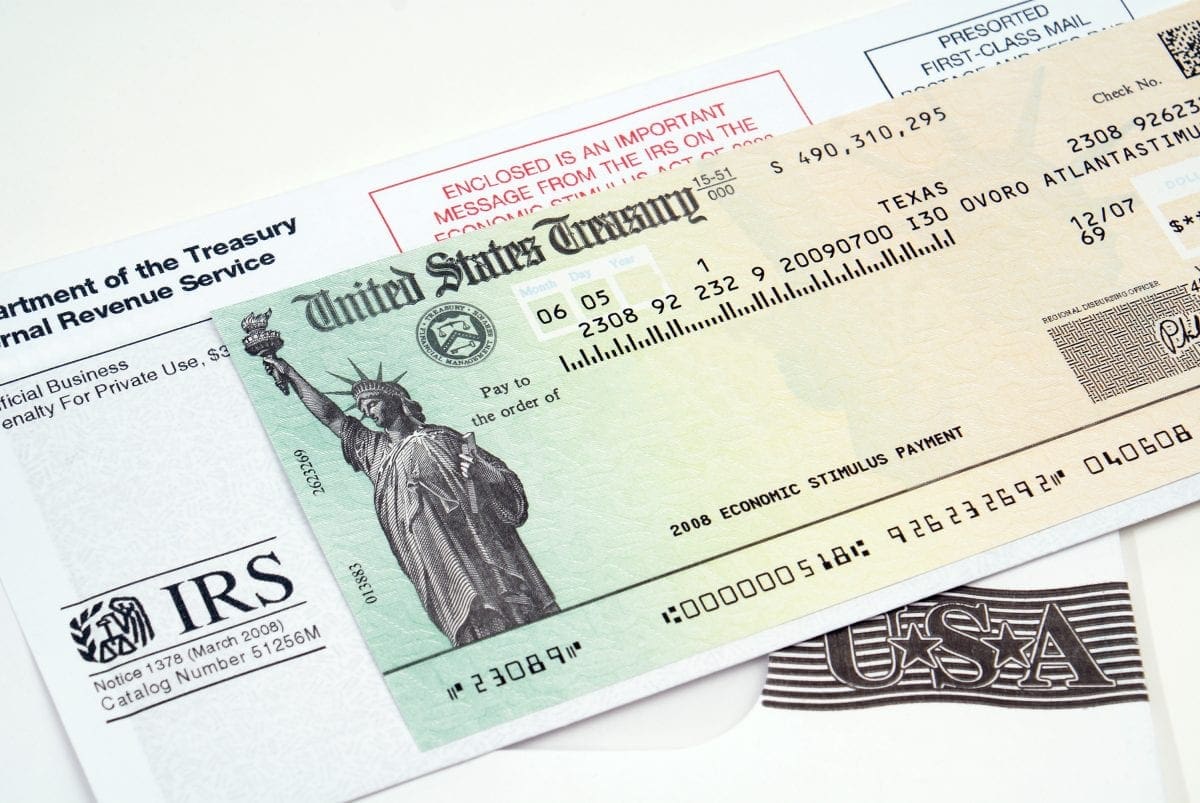

The Federal Government Relied On The Tax System To Provide The Stimulus Checks And Other Benefits

The federal administration had to fall back on the federal tax system, and the Internal Revenue Service to disburse the huge benefits to millions of low and moderate-income citizens under the multiple stimulus check programs, the Economic Impact Payments. It led to the biggest-ever drop in the poverty rate and led to a 4.5% reduction. But the benefits were disproportionate across communities and demographics.

The IRS was the most effective mechanism for the quick disbursement of aid across the US under the trying circumstance post the pandemic. they had all the details necessary to quickly get across to millions of Americans in the shortest possible period.

The IRS quickly disbursed the stimulus checks that required no additional application than filing the income tax return of beneficiaries. And towards this end, they had all the necessary data for efficient and fast disbursal across the length and breadth of the country. It quickly and efficiently delivered the economic impact payments to bank accounts and through paper checks delivered to the addresses in their database.

The IRS Failed To Get Across To A Certain Section Of Society

But the IRS missed out on a large section of the population for the simple reason that such individuals and families do not exist in the records of the tax authorities. This was true for families and individuals with very low incomes and who were less likely to be part of the tax filing compulsions.

Families with little or no knowledge of tax preparation or having little access to the system and also the children who were citizens but with non-citizen parents were more likely to be deprived of the stimulus checks.

The tax structure has transformed into the chief mechanism to send out economic support to households. This includes the economic impact payments and also the expanded Child Tax Credit stimulus checks and various state tax credits.

It is imperative to understand those sections of society that have stayed under the radar of the IRS and ensure that other methods are used to reach out to them. They comprise the most deprived sections of society but were also most likely to miss out on the federal economic impact payments.

The Latinos, Blacks, and other Asian groups were more likely than their white peers to miss out on the stimulus check even though the eligibility for such members for the 2nd and 3rd rounds of payments was extended to include mixed-immigration households.