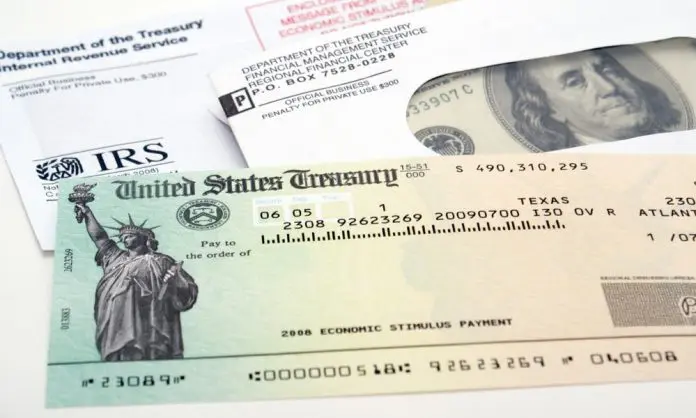

It has been well-documented that millions of American citizens in almost half of the states in the country have already received their Stimulus Checks, tax refunds, rebates, one-time payments, or some other form of payments the previous year.

Now, while the federal payments did dry up quite some time ago, the state initiatives did deliver some much-needed assistance in a year that was riddled with high inflation. For most of the country, 2022 was the last time the federal government helped the citizens. But, there were several states that decided to pick up the slack and distribute payments to the citizens who obviously needed it a lot. However, there are still some states that are still distributing the payments from the programs issued last year- and there are also some that have been accepting applications or qualifying tax returns.

Stimulus Check Payment- New Updates Are Here

One of the updates that came in recently was IRS guided. After much debate and discussion, the agency went on to announce in the middle of February that most people who received special payments in 21 states wouldn’t have to report the stimulus check payments as income. Typically, taxpayers are obliged to report income tax refunds, but the IRS has already ruled that most of the payments would be counted as disaster or general welfare relief, neither of which would be deemed taxable at the federal level. This ruling would further be applied to stimulus check payments that some of the states had issued in 2022.

There are still some states that would be distributing stimulus check payments in 2023. Some have already started distributing outstanding payments to the residents who had applied before deadlines that have already passed, but others are still open and accepting the applications or qualifying the income tax returns.