The Child Tax Credit gave parents a chance to lower their tax burden and offset the expensive proposition of raising a child. The US administration back in 2015 reported that it approximately cost $233,000 to cover housing, food, health care, transportation, child care, clothing, education, and other expenses a child needs to thrive from birth til the age of seventeen.

Fortunately, the child tax credit payments allow low and moderate-income parents to offset these costs and lower their tax bills, it also potentially gave money for extra expenses to such individuals and families.

The child tax credit was worth up to $2,000 for each child who met certain requirements. But following the COVID-19 pandemic, President Biden signed the American Rescue Plan Act in March 2021 immediately after coming to power. The Rescue Plan increased the amount of the child tax credit to between $3,000 and $3,600 for the 2021 tax year depending on the age of the child.

Similar to other tax credits, the Child Tax Credit is a dollar-for-dollar lessening in the income tax liability of an individual or joint filer. A taxpayer does not get an unused portion of the CTC back as a refund, they can only wipe out their tax liability.

Children have to meet the following requirements for their families to be eligible for the child tax credit. The child should be younger than seventeen at the end of the tax year. In 2021, under the Rescue Plan, the age up to which children were eligible for the child tax credit was increased by a year to include children up to the age of seventeen.

The child should also be a son or daughter, stepchild, brother sister, step-brother, foster child, grandchild, step-sister, nephew, or niece. The child can be claimed as a dependent and should not provide over 50% of their support.

The child should also be a citizen of the US, a US resident alien, or a US national. They should also not file a joint return with any other taxpayer unless the reason to file is to claim any refund on tax that has been withheld, or estimated tax paid.

The child must also have a valid taxpayer identification number in the form of a work-authorized Social Security number. Under the expanded version and also before the TCJA, filers could claim children with individual taxpayer identification numbers (ITIN) issued by the IRS, not the Social Security Administration. This helped permanent residents and documented immigrants who were also eligible for the credits.

The CTC payments cannot normally be more than the tax liability of the parent. But a filer may be able to claim the Additional Child Tax Credit that allows them to receive up to $1,5000 of the $2,000 a child as a refund for the tax year 2022.

So filers can claim the amount for the remaining Child Tax Credit, which is up to $1,500 a child after their tax bill has been reduced to zero. Taxpayers can determine if they are eligible for the Additional Child Tax Credit if they fill out the Child Tax Credit Worksheet included in the instruction in Form 1040. For those who qualify, the CTCW directs them to fill out Schedule 8812 and claim the additional CTC.

New Rules For The 2023 Child Tax Credit

The new tax season brings with it another round of claims, forms, and applications. And it is easy to get lost in the complications of filing taxes. But a few carefully planned steps can hopefully make income tax filing way less complicated. For parents and guardians may qualify for several fresh tax credits and deductions linked to their income level.

The maximum tax credit for each qualifying child has been pegged at $2,000, the same as during the pre-pandemic period. Additionally, parents cannot claim a portion of the credit in advance, as was the case for the 2021 tax year.

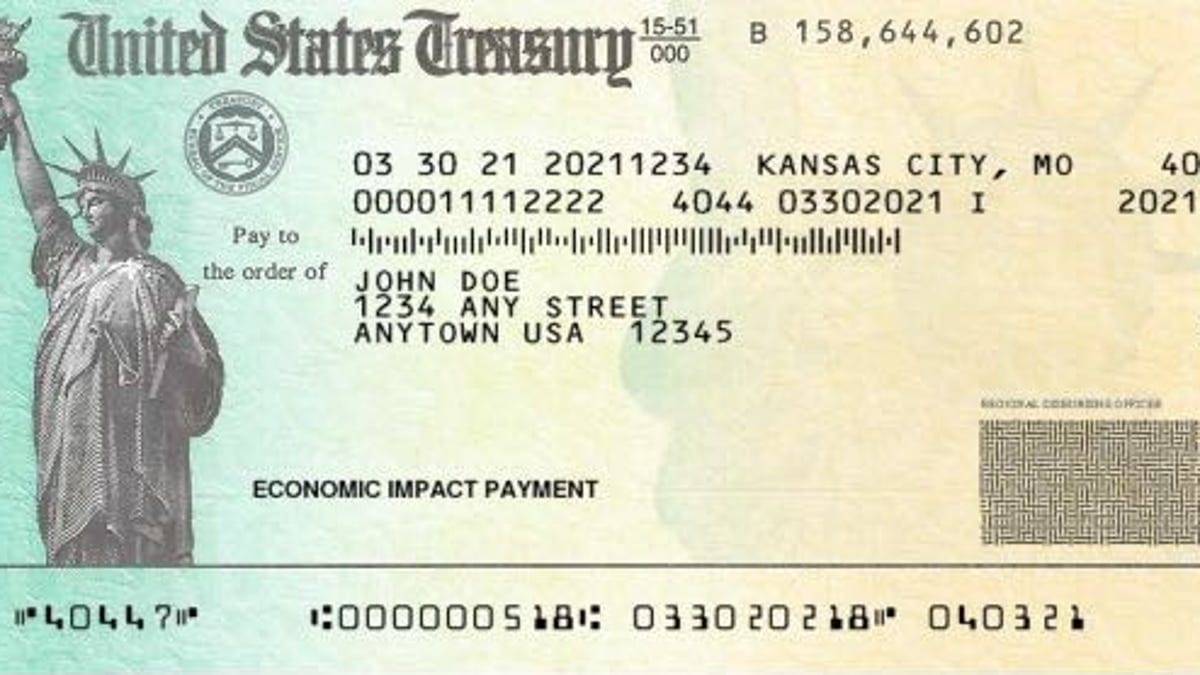

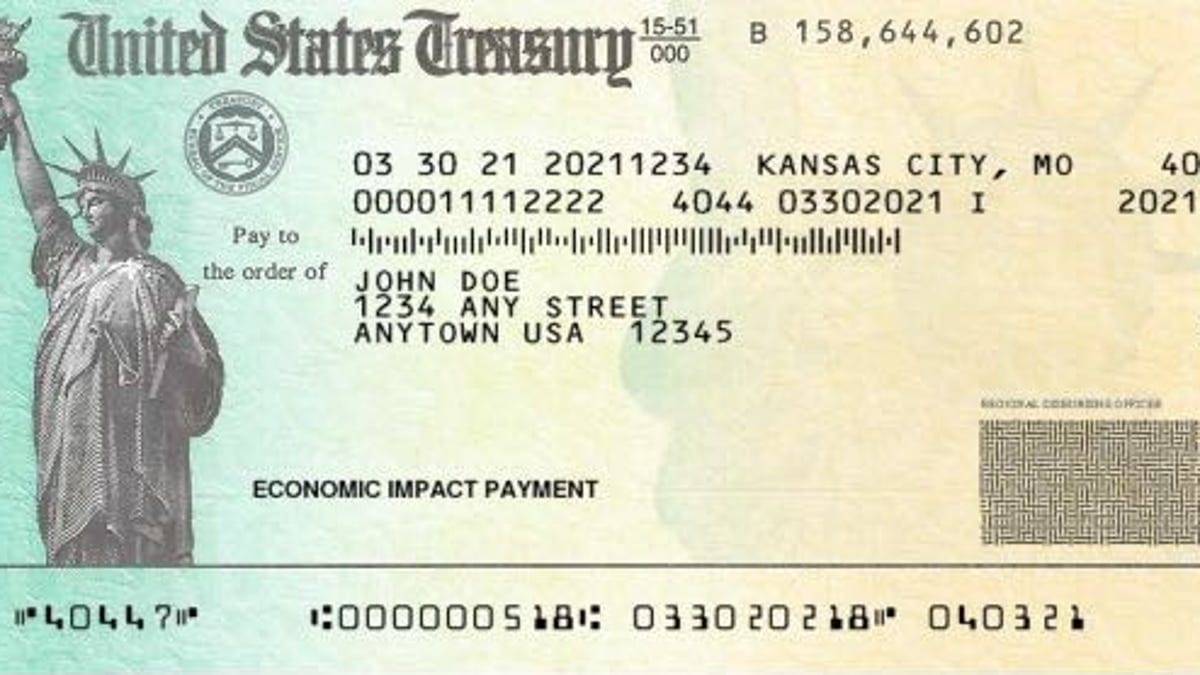

Parents received a monthly check between July and December 2021 between $250 and $300 per child depending on the age of the child. The total amount came to 50% of the total child tax credit amount payable per child. The balance payment was set off against taxes filed for 2021 in the first quarter of 2022. For those with zero tax liability, or a tax amount less than the child tax credit payment, a stimulus check was sent to filers.

The pre-pandemic version of the Child Tax Credit stimulus checks reverts to the pre-2021 version of the payments. The credit amount is smaller, and eligibility is more constricted than in the 2021 tax year. This occurred because the rules established under the Tax Cuts and Jobs Act of 2017 will remain effective through the 2025 fiscal year if Congress does not take the initiative and modify the credit ahead of that.

President Biden has called on Congress to restore fully the Child Tax Credit amount. It gave tens of millions of parents the extra breathing room that they required. It led to a drastic reduction in child poverty and for the first time, millions of low and moderate-income families had the luxury of not worrying about food for their children. it also saved many families from homeless and credit defaults.

In the 2021 income tax year, the Rescue Plan brought in major changes to the credit, though it lasted only one year instead of the five years planned by President Biden for the payments. These changes will be in effect through the fiscal year of 2025 unless Congress brings in some major changes and modifies the credit amount.

Like in 2022, income tax filers with eligible children are in line for a credit amount that could be worth up to $2,000 for each child. This year the credit has been made partially refundable. There is also an earning threshold to start claiming the maximum of $1,400 which is the Additional Child Tax Credit.

Filers whose tax liability is lower than the refundable amount will then get the amount credited to their tax refund amount. The non-refundable portion will lead to a reduction of the taxes that are owed in full.