The expanded version of the Child Tax Credit stimulus checks had helped the quiet revolution of directly giving money to families with children. For the 6 months that it stayed in effect in the last two quarters of 2021, the expanded version of the Child Tax Credit provided parents of American children with monthly payments of $250 to $300 for each child.

At the time of tax filing in 2022, people got another cash assistance, this time as a lump-sum payment. The expanded version of the Child Tax Credit stimulus check proved to be a live saver for American families with children. For the first time, the CTC payments could be claimed only by tax filers, though it was not necessary to give taxes to receive their check.

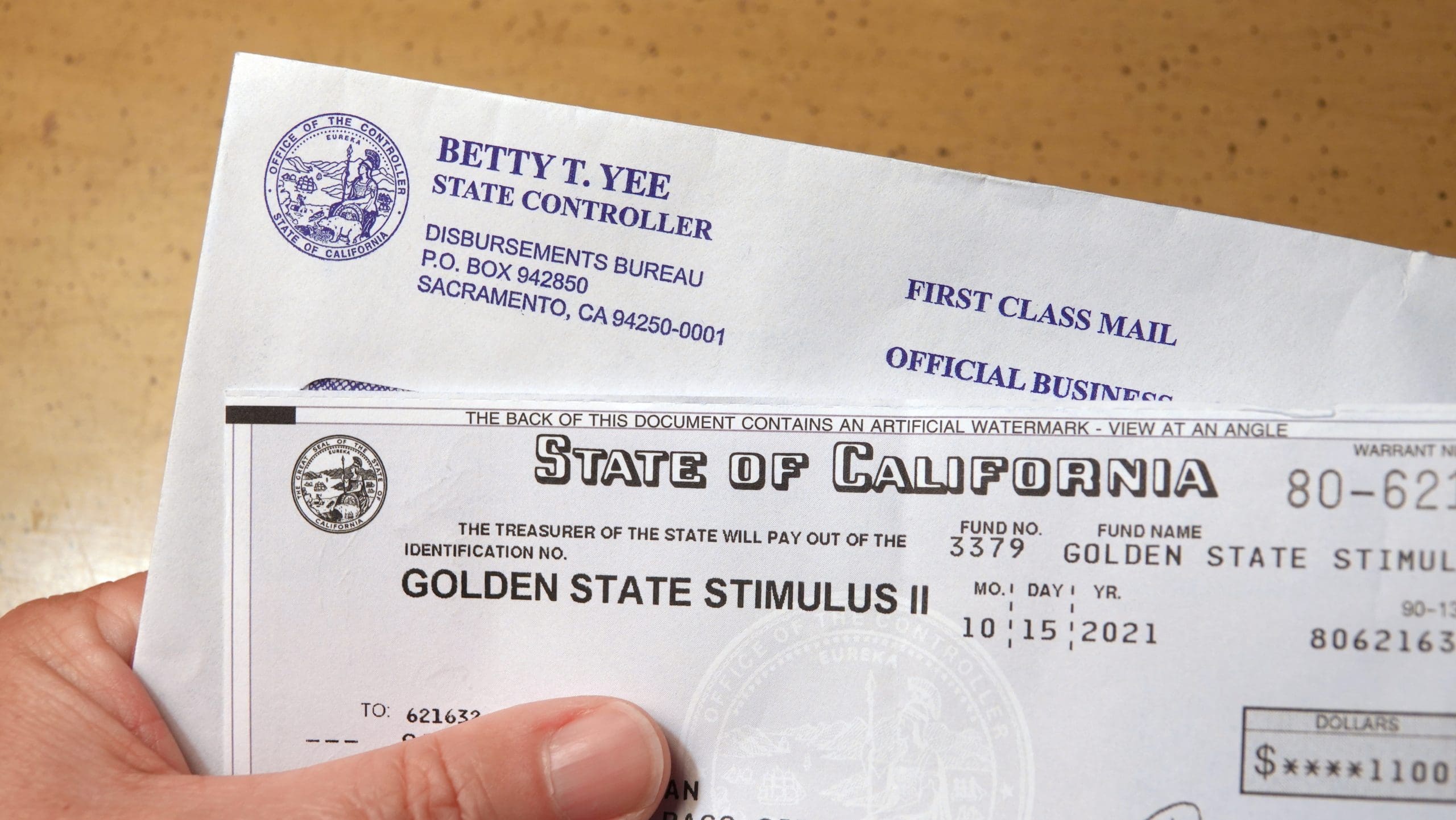

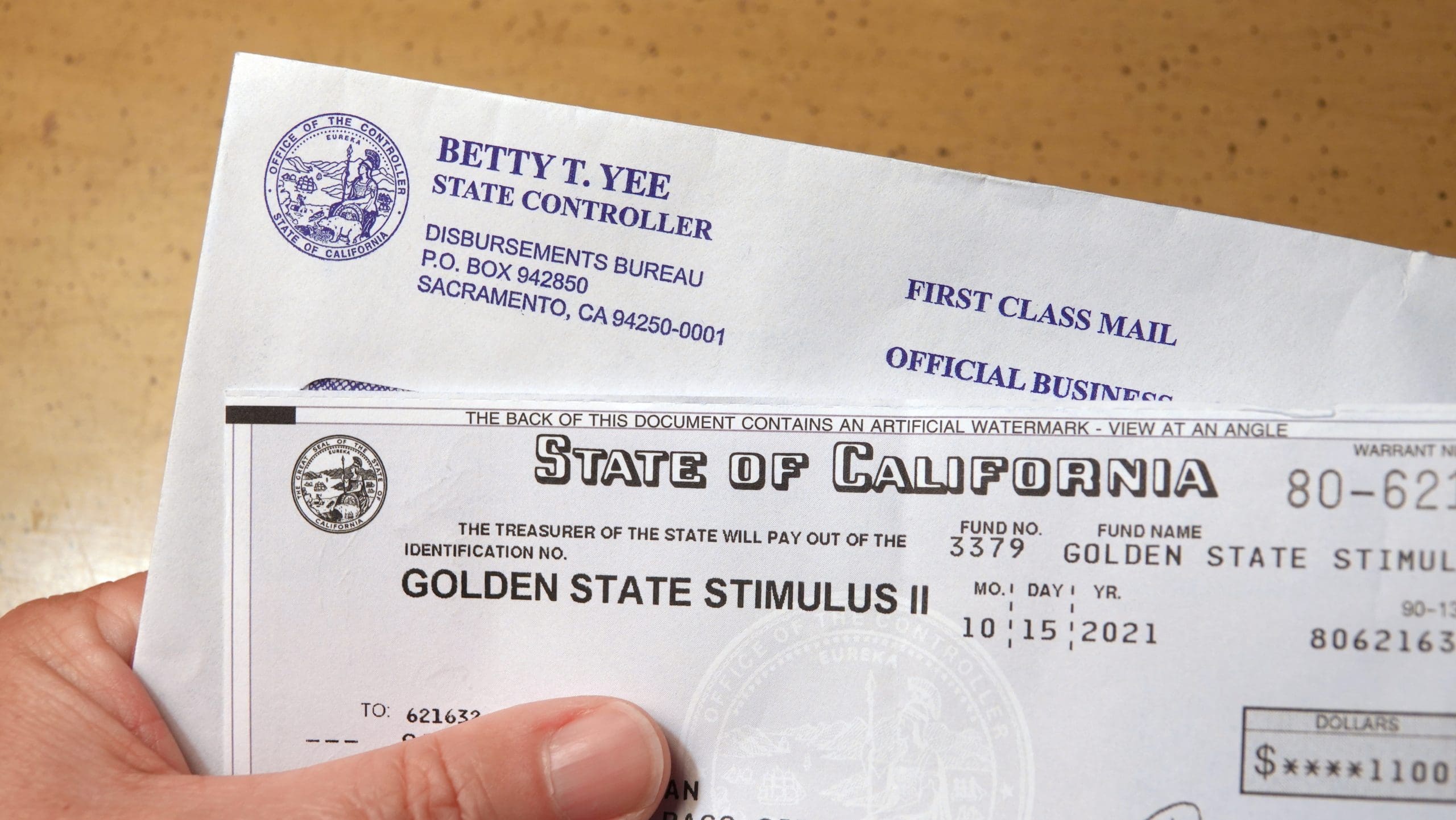

This lifesaver quietly heralded a revolution in money distribution. At its peak effectiveness, child poverty was slashed by roughly 30%. The last of the CTC stimulus checks went out as a credit to a bank account, or as a paper check, in December 2021. By this time, the benefit succeeded in helping 3.7M children stay out of the clutches of sustained poverty.

CTC Stimulus Checks A Quiet Revolution In American Welfare Policy

But Congress, or the Republican part of it, opted not to extend the program, and it quietly died a death after just payments for the tax year 2021. America suffers from a shamefully high rate of child poverty, and studies showed that it significantly reduced it for the first time.

The expanded Child Tax Credit stimulus check was one of the first new programs in decades to provide Americans with a government allowance in cash, and it came with virtually no special conditions or restrictions.

Other federal welfare programs come with a string attached, including work requirements. They may also be limited to specific populations and other demographics, like people with disabilities or with low income. Other federal welfare programs only provided benefits-in-kind, such as food stamps, rather than direct stimulus checks.

The expanded Child Tax Credit stimulus check was closer to the Social Security payments for people below 18 years. It was a form of universal basic income. Close to 90% of all American children were eligible for the CTC stimulus checks under this program. At its peak, it gave support to around 61M children.

The Universal Basic Income, or UBI, was a government aid that sent money to everyone like a national paycheck to take care of the basics of life. There exists another related guaranteed income, which is slightly different though. It replaces or augments the existing welfare measures that are aimed at low-income people with simpler and straightforward regular cash assistance.

Both programs consist of giving out money to people. This notion has gained recognition and popularity in social-policy circles for years. It shot to mainstream fame when US presidential candidate, Andrew Yang backed it in his campaign for the 2020 Democrat presidential primary.

A consistent and strong backer of the guaranteed income is the Federal Economic Security Project. It is an advocacy group that came into existence in 2016 under Chris Hughes. He is one of the co-founders of Facebook and has turned into an activist of late. Other supporters include Dorian Warren and Natalie Foster.

In the past several years, the Economic Security Project has supported 100 pilot projects around America to test a guaranteed form of income for all citizens. The pilot projects are in multiple stages of development. But around 80 such initiatives have already concluded and have started giving out payments to beneficiaries. Ultimately, around 38,000 participants are expected to benefit as $500 million of money is distributed.

The Economic Security Project has also turned out to be a leading political champion of the expanded CTC stimulus checks. the group advocates that both forms of development, the experience of helping the incubation and growth of the pilot projects, and also the tremendous positive response of the expanded CTC stimulus checks have proved a fundamental idea that it helps if people are directly provided aid in cash instead of going about it indirectly.

The CTC Stimulus Checks Proved The Feasibility Of A Guaranteed Income

The CTC stimulus checks and the pilot programs have proved that it is logistically and economically feasible to have a guaranteed income that will lead to far-reaching effects on reducing poverty and improving housing and food security. More generally it can lead to all-around improvement in the quality of life.

The CTC stimulus checks and other similar programs including the Economic Impact Payments have proved that it is possible to move away from the 5-decades of safety net policymaking. The latter made it more difficult to obtain aid and rendered the system more complicated. The result was that fewer people had access to it as the vast majority were put off, or were disqualified, by the rules surrounding it.

This trend has been reversed through these direct payments and strengthened the premise that there should be a guaranteed income at the federal level that goes along with wages in the US.

The advocates of guaranteed or basic income programs argue that they assure many advantages over age-old welfare programs. The primary one is that of simplicity.

To alleviate exaggerated and misplaced notions that people receiving assistance turn dishonest and lazy, the federal government made it more and more difficult to access welfare programs. It has been larded with multiple and complicated requirements of eligibility.

This resulted in a situation that many people who could be brought under the net of federal benefits are denied the amount. And the reason is a lack of clarity and knowledge of the programs, plus an inability to jump through the many bureaucratic circles.

The traditional forms of welfare measures can also undermine the very purpose of the program as it allows the government, and not the recipients, to decide on how to spend the money. The actual needs of the people may go unfulfilled.

The CTC stimulus check, though, is not a new idea. It was started way back in 1997 by a Democratic president and a Republican Congress. It has expanded under every successive president. The key difference is how the two parties look at it. While the Democrats peg the program as a form of help for the working class, Republicans say that is a tax cut.