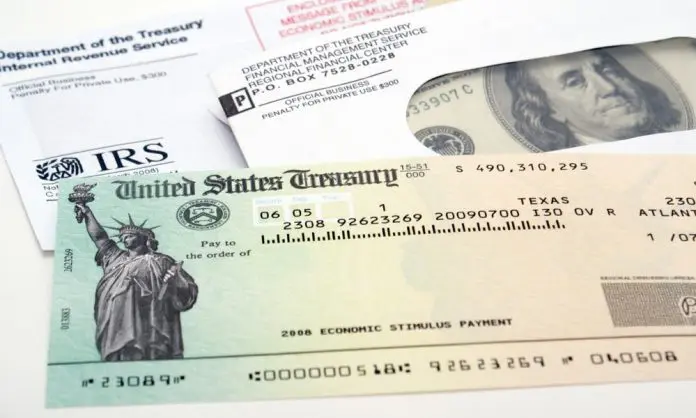

2020 was by far the bleakest year for Americans in several decades as they stared at an uncertain future. The pandemic was at its peak and the federal administration was caught unaware as it dithered in declaring an immediate lockdown. But by the end of the first quarter, it realized the potential for destruction and immediately declared a total shutdown accompanied by the declaration of the first of a series of stimulus checks.

While the stimulus check, or the economic impact payments, went out to low and moderate-income Americans, it stopped at a crucial time even as the economic fallout of the pandemic continued to present itself. While there was a mini-economic boom during that period, for most Americans, the situation was yet to improve.

Unemployment remained high and businesses had shut down in large numbers, many permanently. In that situation, the sudden end of the federal stimulus checks spelled doom for many American households. And the greatest loss was the discontinuation of the expanded version of the Child Tax Credit stimulus check.

The End Of The CTC Stimulus Check Was A Setback For Low-Income Households

The greatest setback for low and moderate-income households was the sudden end to the enhanced version of the Child Tax Credit stimulus check. The Child Tax Credit stimulus check was the most beneficial of the schemes announced by President Biden and was universally acknowledged for the way it brought down child poverty by almost 50% during the period it was given in the last two quarters of 2021.

The monthly stimulus checks of between $250 and $300 between July and December 2021 ensured food and shelter for these children throughout the difficult period. Even in the first quarter of 2022, the balance amount was sufficient to see them through the first two quarters of 2022.

2022 Was The Year Of State Stimulus Checks

The three stimulus checks and the other support measures including the Child Tax Credit stimulus check and the extended unemployment check ensures that people across America have some means of sustained support for close to two years.

With the end of federal support, the states took over, mainly to provide residents relief from rising prices. From an average of below 2% before the pandemic, inflation began an unrelenting march throughout 2022, reaching a peak in June 2022 when I crossed the 9% mark to finally end at 9.1%. this was the highest inflation rate in over 4 decades.

Prices of every product and service were affected and the price of gasoline and groceries saw a 50% at one stage. Prices gradually eased in the last quarter of 2022. But despite the slide, the inflation rate has to remain at thrice the level it was during the pre-pandemic period.

It was here that the state stimulus checks have come in handy. The support given by around 21 states has to a certain extent eased the burden of many American families. The amount has ranged across states but has not reached the extent of wide-ranging support provided by the federal government’s economic impact payments.

Stimulus Check Amount Varies Across States

The support afforded by states has varied widely and some states like Alaska, Maine, California, New York, New Mexico, and New Jersey have taken the lead and provided up to $5,500 under various heads.

Some of the payments are revisions of ongoing regular aid, like the one given by the Alaskan government which includes a payment from the energy revenues collected by the oil-rich state. This payment goes out to almost all residents of the Last Frontier.

California has also been generous with its stimulus checks and has given two rounds during the pandemic. The latest round is known as the Middle-Class Tax Rebate was announced by Democrat Governor Gavin Newsome. Residents received up to $1,050 in the last quarter of 2022 and the first quarter of 2023.

The payments were linked to the 2020 state income tax returns with an individual with an AGI of up to $250,000 and married couples with an AGI of up to $500,000. The maximum amount of $1,050 goes out to joint filers with an AGI for California of less than $150,000. While the individual payment under this slab was $350 for each filer, an additional $350 was payable for a dependent. The payment for dependents is limited to only one person despite the possibility of there being more than one.

While the majority of the California stimulus checks were completed by the last quarter of 2022, the payment that went out by debit cards was delayed and dragged on for the whole of the first quarter of 2023.

The Colorado state stimulus check comes to $750. The new law (Senate Bill 22-233) was signed on May 23 last year. It gave $750 to individuals and double that to joint filers that summer. The law provided immediate relief to Coloradans by sending them a check that summer instead of the spring of 2023.

Beneficiaries must have filed their state return by October 17, 2022, to be eligible for the Colorado Cash Back stimulus check. Filers needed to ensure they have given the correct address in the records of the department. The stimulus checks will be mailed to the last known address. Residents can update their addresses by either creating an account on Revenue Online or by logging. They can also submit a completed form for address change (DR 1102).

Qualifiers must be at least eighteen years as on December 31, 2021, and should have been a resident of the state for the entire 2021 tax year. The Colorado Cash Back is a one-time tax refund of state revenue from the state fiscal year 2021-2022. It is different from the Great Colorado Payback which is an ongoing program from the state treasury department to help resident locate their unclaimed property.

It is important to remember that the only way residents could claim the cashback stimulus check was by filing their state income tax returns for 2021.

Florida was one of the few Republican states to announce a stimulus check for its residents. Foster parents, non-relative and relative caregivers, and families getting TANF cash assistance and under the Guardianship Assistance Program receive a payment of $450.